When it comes to finding reliable and efficient online loan providers, MaxLend is a popular choice for many. However, there are several other platforms that offer similar services, providing quick access to funds with varying terms and benefits. In this article, we’ll explore top money online sites like MaxLend: ExtraLend.com, Lendplans.com, Maximusmoney.com, SpotlightLoans.com, and Lendyou.com. Each of these platforms offers unique features and advantages, ensuring you find the right fit for your financial needs.

MaxLend.com

MaxLend.com is an online lending platform that provides short-term loans to individuals who need quick access to cash. Known for its straightforward application process and rapid funding, MaxLend aims to offer a convenient financial solution for those facing unexpected expenses or temporary financial shortfalls. Unlike traditional lenders, MaxLend operates entirely online, allowing applicants to complete the process from the comfort of their own homes.

Key Features

- Quick Application Process: The application process on MaxLend.com is designed to be fast and user-friendly. Applicants can complete the form online in just a few minutes, and the approval process is typically swift, often providing a decision within hours.

- Rapid Funding: Once approved, funds can be deposited into the borrower’s bank account as soon as the next business day, making it an excellent option for urgent financial needs.

- Flexible Loan Amounts: MaxLend offers flexible loan amounts tailored to the borrower’s specific needs and financial situation, helping them manage their short-term financial requirements effectively.

- No Credit Check: MaxLend does not rely heavily on traditional credit checks, making it accessible to individuals with less-than-perfect credit scores.

Benefits

MaxLend is particularly beneficial for those who may not qualify for traditional loans due to poor credit history. By focusing on factors beyond credit scores, such as employment status and income, MaxLend provides an opportunity for borrowers to access funds when they need them most. This can be especially helpful in emergencies where immediate financial assistance is required.

Money Online Sites Like MaxLend

1. BadCreditLoans

BadCreditLoans.com is an online lending platform designed to connect individuals with poor or limited credit histories to a network of lenders willing to offer short-term loans. The site aims to provide a straightforward and accessible way for people with bad credit to obtain the funds they need for various financial needs, from unexpected expenses to debt consolidation. BadCreditLoans.com acts as a mediator, facilitating the loan application process and matching borrowers with potential lenders.

Key Features

- Wide Network of Lenders: BadCreditLoans.com connects applicants to a broad network of lenders, increasing the chances of loan approval despite poor credit scores.

- Simple Application Process: The application process is user-friendly and can be completed online in just a few minutes. Applicants provide basic personal, financial, and employment information.

- Quick Decision and Funding: Once the application is submitted, borrowers can receive loan offers quickly, often within minutes. Approved funds can be deposited into the borrower’s bank account as soon as the next business day.

- Loan Amount Flexibility: The platform offers loan amounts ranging from $500 to $10,000, catering to a variety of financial needs.

- No Obligation to Accept Offers: Applicants are not obligated to accept any loan offers they receive, providing the freedom to compare and choose the best option.

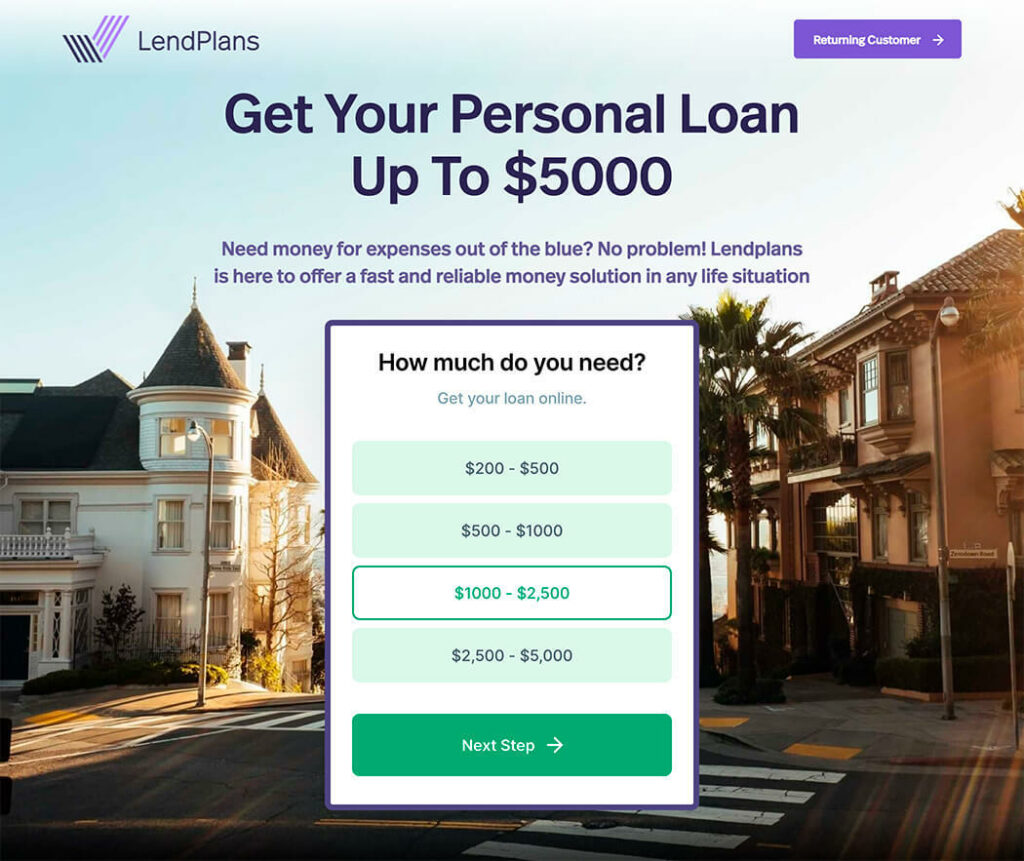

2. Lendplans.com

Lendplans.com is another excellent alternative to MaxLend, offering a variety of loan options to meet your financial requirements. Whether you need a short-term loan or a more substantial personal loan, Lendplans.com provides a seamless online application process.

Key Features:

- Diverse Loan Options: Access various loan types tailored to your needs.

- User-Friendly Interface: Navigate the website easily to find and apply for loans.

- Transparent Terms: Clear and understandable loan terms and conditions.

3. Maximusmoney.com

Maximusmoney.com stands out as a strong competitor among online sites like MaxLend. It offers competitive interest rates and flexible loan amounts, making it a versatile option for borrowers.

Key Features:

- Competitive Rates: Benefit from attractive interest rates compared to traditional lenders.

- Flexible Loan Amounts: Choose loan amounts that match your financial needs.

- Fast Processing: Experience quick loan processing and fund disbursement.

4. SpotlightLoans.com

SpotlightLoans.com is designed to provide borrowers with quick and convenient access to funds. Like MaxLend, SpotlightLoans.com offers a straightforward application process and fast approval times.

Key Features:

- Instant Approval: Get instant approval decisions to address urgent financial needs.

- No Hidden Fees: Enjoy transparency with no hidden fees or surprise charges.

- Multiple Loan Options: Explore various loan products to find the best fit.

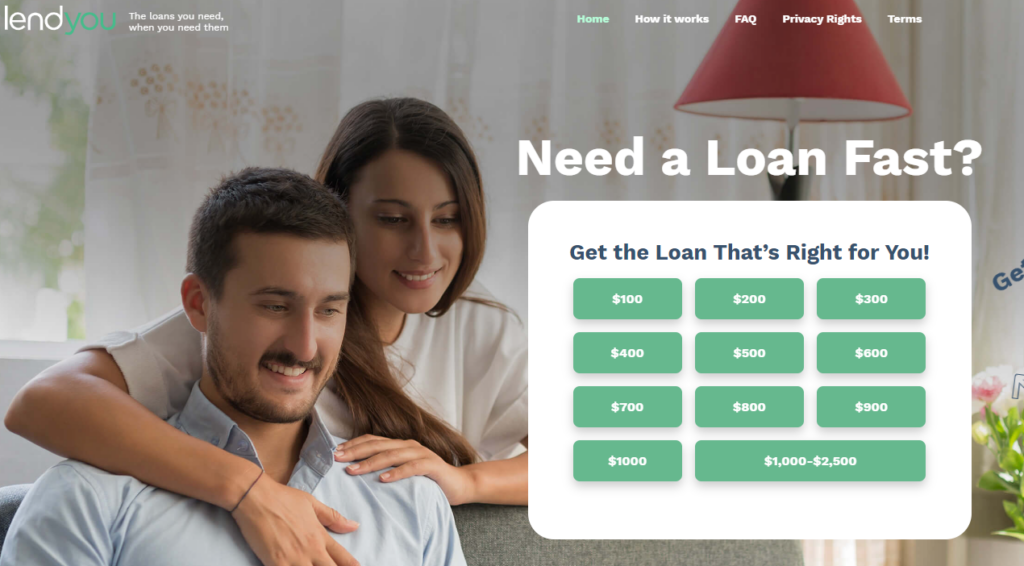

5. Lendyou.com

Lendyou.com is a trusted platform for securing personal loans quickly and efficiently. With a focus on customer satisfaction, Lendyou.com provides a reliable alternative to MaxLend.

Key Features:

- Customer Support: Access dedicated customer support to assist with your loan application.

- Easy Application: Complete a simple online application in just a few minutes.

- Fast Funding: Receive funds quickly upon approval to meet your financial needs.

Finding the right online loan provider can make a significant difference in managing your financial needs efficiently. While MaxLend is a popular option, exploring other online sites like MaxLend can offer you additional benefits and flexibility. Platforms like ExtraLend.com, Lendplans.com, Maximusmoney.com, SpotlightLoans.com, and Lendyou.com each provide unique features and advantages that can cater to your specific requirements. Whether you need quick cash for an emergency or a larger loan for significant expenses, these alternatives ensure you have access to the funds you need with ease and confidence.

By considering these online sites like MaxLend, you can make an informed decision and choose the best loan provider for your financial situation. Each platform offers a secure and efficient process, ensuring you get the support you need when you need it most.

How Money Online Sites Like MaxLend Can Help Improve Credit

Money online sites like MaxLend can be a valuable resource for individuals looking to improve their credit scores. These platforms offer short-term loans that, when used responsibly, can demonstrate your ability to manage debt effectively. By taking out a loan and making timely payments, you can build a positive payment history, which is a crucial factor in your credit score. Most credit bureaus consider on-time payments as one of the most significant indicators of creditworthiness. Therefore, using services from sites like MaxLend to make consistent, on-time payments can help you gradually improve your credit score over time.

Additionally, these online lending platforms often report your payment activity to major credit bureaus. This reporting can positively impact your credit profile, especially if you lack a robust credit history. Establishing a track record of responsible borrowing and repayment shows lenders that you are a reliable borrower. This positive activity can help boost your credit score, making it easier to qualify for better loan terms, lower interest rates, and higher credit limits in the future. By leveraging the services offered by money online sites like MaxLend, you can take proactive steps toward improving your credit health and achieving your financial goals.