If you’re looking for similar sites like LendUp, there are several other websites that offer similar services. In this article, we will explore similar sites like LendUp, including Ace Cash Express, SuperMoney.com, Quickencompare.com, OnlineCashAdvancers.com, and PayDaySos.com. Each of these platforms provides unique features and benefits, making them excellent choices for short-term loans and financial assistance.

LendUp is a well-known online lending platform that provides short-term loans and financial education to help consumers build credit and improve their financial health. Known for its unique “LendUp Ladder” program, LendUp aims to offer better loan terms and lower rates over time as borrowers demonstrate responsible borrowing behavior. By focusing on transparency, education, and fair lending practices, LendUp has become a popular choice for individuals looking for quick financial solutions without resorting to traditional payday loans.

Similar Sites Like LendUp

Ace Cash Express

Official Site

Ace Cash Express is a reputable provider of payday loans, installment loans, and other financial services. With a wide network of physical locations and an easy-to-use online platform, Ace Cash Express offers convenience and accessibility to its customers.

Key Features:

- Diverse Loan Options: Offers payday loans, installment loans, title loans, and more.

- Fast Approval: Quick application process with fast approval and funding.

- In-Store and Online Services: Access loans and services both in-store and online.

Ace Cash Express is a strong alternative among similar sites like LendUp, providing a variety of loan options and flexible service delivery.

SuperMoney.com

Official Site

SuperMoney.com is a comprehensive financial services comparison site that helps consumers find the best loans, credit cards, insurance, and other financial products. By comparing multiple lenders and services, SuperMoney.com ensures that users can make informed decisions about their financial needs.

Key Features:

- Loan Comparison: Compare personal loans, payday loans, and installment loans from various lenders.

- Transparent Reviews: Read user reviews and ratings to choose the best financial products.

- Educational Resources: Access financial guides and articles to improve financial literacy.

For those seeking similar sites like LendUp, SuperMoney.com offers a valuable service by providing a transparent and comprehensive comparison of financial products.

Quickencompare.com

Official Site

Quickencompare.com is a financial comparison platform that focuses on helping consumers find the best loan products and financial services. The site offers comparisons for personal loans, credit cards, mortgages, and more, ensuring that users can find the right financial solutions for their needs.

Key Features:

- Personal Loan Comparison: Easily compare personal loan offers from multiple lenders.

- User-Friendly Interface: Simple and intuitive design for easy navigation.

- Financial Tools: Utilize calculators and tools to better understand loan terms and conditions.

Quickencompare.com stands out as a useful resource among similar sites like LendUp, offering detailed comparisons and financial tools to aid in decision-making.

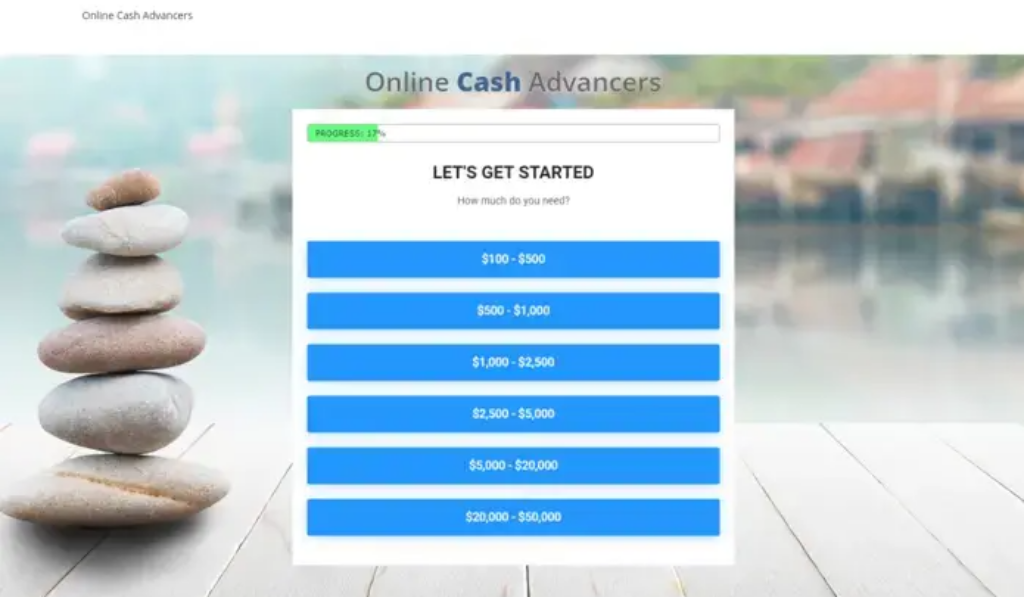

OnlineCashAdvancers.com

Official Site

OnlineCashAdvancers.com specializes in providing short-term payday loans to help individuals cover unexpected expenses. The site offers a straightforward application process and quick funding, making it a convenient option for those in need of immediate financial assistance.

Key Features:

- Simple Application: Easy online application process with quick approval.

- Fast Funding: Receive funds as soon as the next business day.

- Flexible Loan Amounts: Borrow small amounts to cover short-term needs.

As one of the similar sites like LendUp, OnlineCashAdvancers.com offers a fast and efficient solution for short-term financial needs.

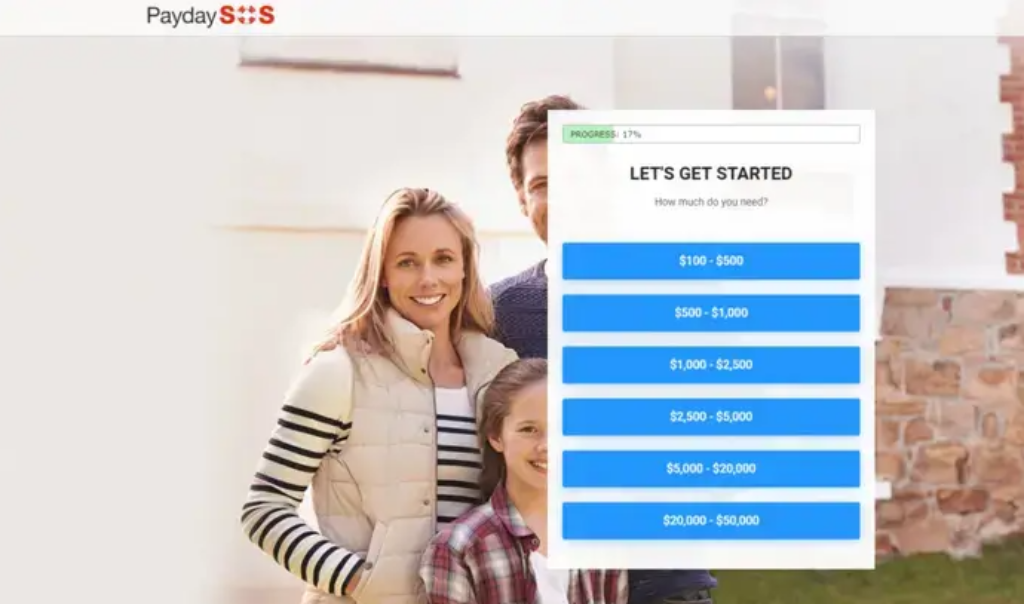

PayDaySos.com

Official Site

PayDaySos.com is an online lending platform that connects borrowers with a network of lenders offering payday loans and other short-term financial products. The site aims to provide quick and easy access to funds, helping individuals manage unexpected expenses.

Key Features:

- Wide Lender Network: Access a broad network of lenders to find the best loan offers.

- Quick Application: Fast and straightforward application process.

- Immediate Funds: Receive loan funds quickly to address urgent financial needs.

PayDaySos.com is a valuable addition to the list of similar sites like LendUp, providing a reliable and efficient way to secure short-term loans.

Conclusion to Similar Sites Like LendUp

While LendUp is a popular choice for short-term loans and financial education, there are several other excellent alternatives worth considering. Sites like Ace Cash Express, SuperMoney.com, Quickencompare.com, OnlineCashAdvancers.com, and PayDaySos.com each offer unique features and benefits that can help you meet your financial needs. By exploring these similar sites like LendUp, you can find the best loan options and financial services to suit your specific situation. Whether you need quick cash, want to compare loan offers, or seek educational resources to improve your financial health, these platforms provide valuable tools and support.

Pros and Cons of Using Short-Term Loans

Pros of Short-Term Loans

Short-term loans offer several advantages, especially for individuals who need quick access to funds. One of the primary benefits is the speed of approval and disbursement. Unlike traditional bank loans, which can take weeks to process, short-term loans are typically approved within hours, and the funds are often available within the same day or the next business day. This rapid turnaround time makes them ideal for emergency expenses such as medical bills, car repairs, or unexpected household needs.

Another significant advantage of short-term loans is their accessibility. These loans are available to a broader range of people, including those with less-than-perfect credit. Many lenders do not require a high credit score for approval, focusing instead on the borrower’s current financial situation and ability to repay the loan. This accessibility can be a lifeline for individuals who may not qualify for traditional loans due to their credit history.

Flexibility and Convenience

Short-term loans also offer flexibility in terms of loan amounts and repayment periods. Borrowers can typically choose the amount they need, which can be as small as a few hundred dollars, and select a repayment term that suits their financial situation, usually ranging from a few weeks to a few months. This flexibility allows borrowers to tailor the loan to their specific needs without committing to long-term debt.

The convenience of the application process is another advantage. Most short-term loan applications can be completed online, eliminating the need for lengthy paperwork or in-person visits to the bank. This ease of access allows borrowers to apply from the comfort of their home and receive quick decisions, making the process hassle-free and straightforward.

Cons of Short-Term Loans

Despite their benefits, short-term loans come with several drawbacks that borrowers should consider. One of the most significant disadvantages is the high cost associated with these loans. Short-term loans often come with high interest rates and fees, which can make them expensive. The annual percentage rate (APR) for short-term loans can be significantly higher than that of traditional loans, leading to substantial repayment amounts over a short period.

Another downside is the potential for a debt cycle. Due to the short repayment terms and high costs, some borrowers may struggle to repay the loan on time. This situation can lead to taking out additional loans to cover the original debt, creating a cycle of borrowing and repaying that can be difficult to break. This cycle can quickly escalate, leading to increased financial stress and long-term debt issues.

Impact on Credit and Financial Health

Short-term loans can also impact your credit score negatively if not managed properly. Missing payments or defaulting on a short-term loan can result in late fees and damage to your credit report. While these loans can provide immediate financial relief, failing to repay them on time can lead to further financial difficulties, including a lower credit score and reduced access to future credit.

Moreover, the ease of access to short-term loans can sometimes lead to impulsive borrowing. Without careful consideration and planning, borrowers may take out loans for non-essential expenses, leading to unnecessary debt. It’s crucial for borrowers to evaluate their financial situation carefully and consider whether a short-term loan is truly necessary and if they can realistically manage the repayment terms.

Conclusion

Short-term loans can be a valuable resource in times of financial need, offering quick access to funds and flexible repayment options. However, they come with high costs and potential risks, including the danger of falling into a debt cycle and impacting your credit score. It’s essential for borrowers to weigh the pros and cons carefully, consider alternative funding options, and ensure they can meet the repayment terms before taking out a short-term loan. By doing so, they can make informed decisions that support their financial health and avoid potential pitfalls associated with short-term borrowing.