Do you find yourself vacationing more in the winter than you should? Or are you having trouble breaking a bad spending habit? Checking the essentials can help you manage your income, spending habits, and money from one year to the next.

When it comes to tax season, you want to make sure you have all the paperwork completed for the upcoming year. Not knowing how to file taxes properly can cost money and time.

Start with this list of the most common tax forms if you’re trying to wrap your head around the tax code. Make sure to prepare and file them all accurately and on time.

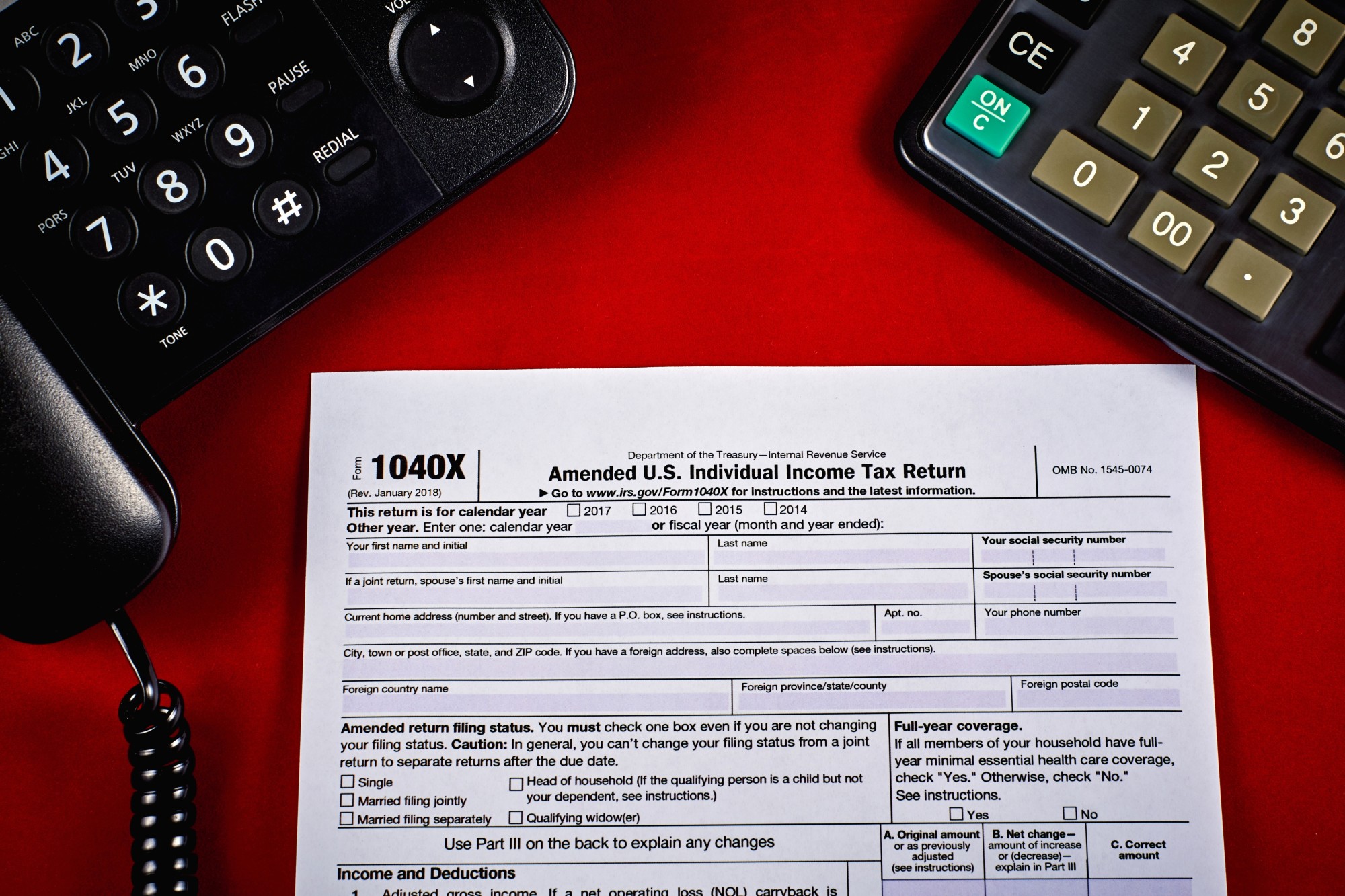

Overview of the 1040 Form

The 1040 form is the most common tax form amongst all forms and is an integral part of the tax return process. It is titled “U.S. Individual Income Tax Return,” and it is used to report an individual’s yearly wages, salaries, and other earned income for the calendar year. Along with this are deductions and adjustments.

Additionally, the 1040 Form also reports all types of investment income, such as dividends and capital gains which are subject to tax. It is accompanied by several forms, schedules, and attachments that taxpayers use to determine the best way to get their taxes done.

Completing the W-2 Form

The W-2 form is typically completed by the employer and provided to the employee. It shows the employee’s wages and other specific compensation, withholdings, and taxes. It also shows the employee’s Social Security, Medicare withholding, and other deductions.

Completing the W-2 form can be a complicated process for the employer. However, it is an important form that needs to be done correctly to ensure the accurate filing of taxes.

Filling Out a 1099 Tax Form

The 1099 tax form is used to report any type of income that is not derived from wages and salary. This includes self-employment income, rent, royalties, and interest payments. These are important documents needed to be completed properly to avoid penalties and fees.

Businesses send out 1099 tax documents to their contractors to report payments. Contractors then fill out their 1099 tax forms and submit them to the IRS along with filing their returns. Filing a 1099 tax form can help contractors determine the amount of taxes to be paid.

A 1099 form can be filled out online or by hand, but make sure you follow the IRS regulations for filing taxes using this form. It must be sent to both the IRS and the recipient of the income. You can ask a reputable 1099 printing and mailing service to do this for you.

Exploring the Most Common Tax Forms

Filing taxes doesn’t have to be a daunting process. With the numerous tax forms out there to help you calculate and file, learning which ones you need should be simple. By understanding the most common tax forms like 1040, W-2, and 1099, you can make the filing process easier and get the most out of your tax return.

Don’t forget to browse our site for advice on business, products, services, and more.