Tax time is a tough time of year. And, it’s a busy time. Over 148 million tax returns were filed in 2019 alone.

But, if you don’t want to pay for a professional, how do you ensure that your taxes are done correctly?

Let’s go through how to do your own taxes.

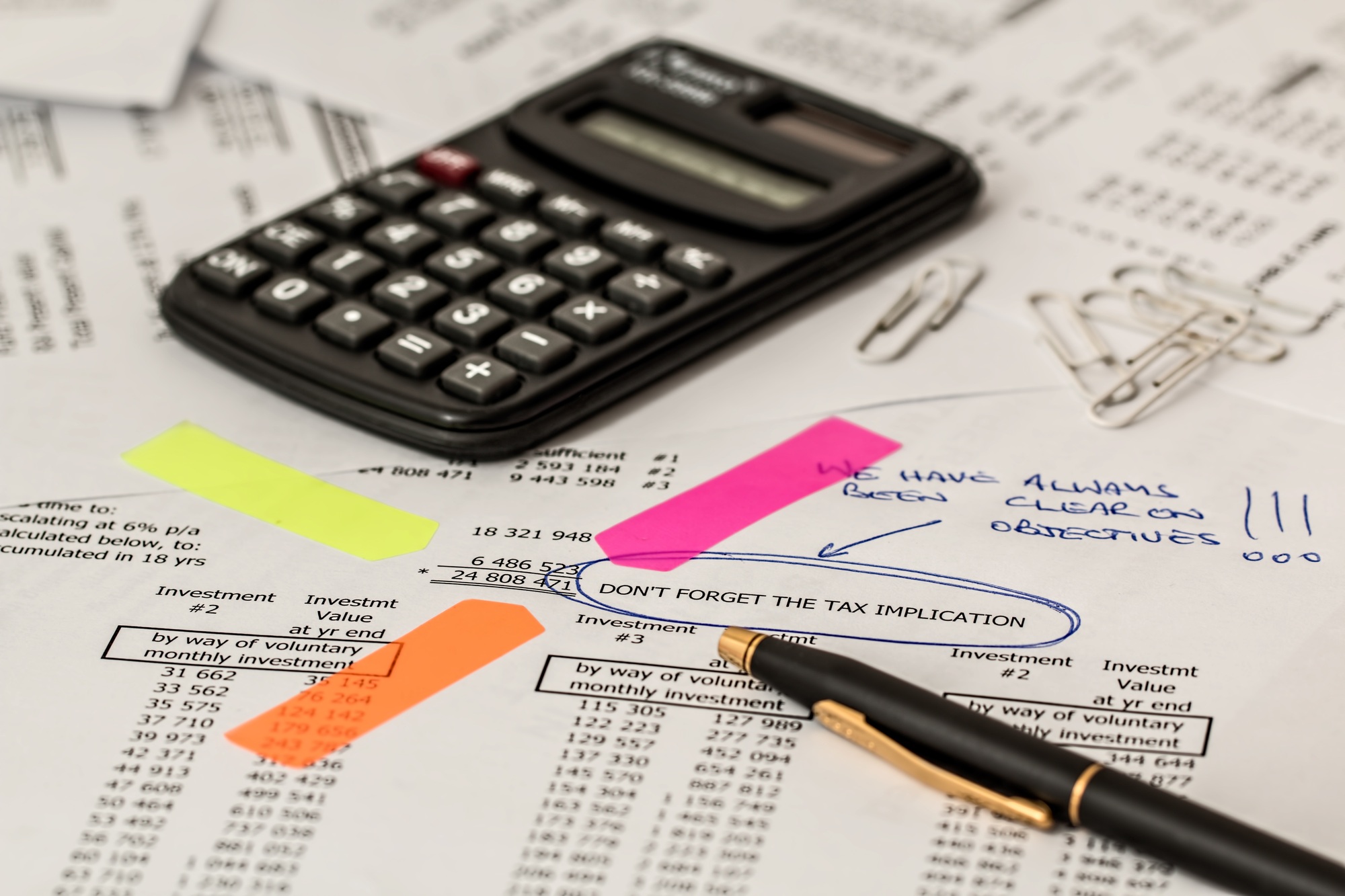

Gather Up Your Paperwork

The first thing you need to do when trying to file your own taxes is to gather all the relevant paperwork. You need to ensure you have an accurate record of your income for a given year. You also need accurate records for all of your possible deductibles.

Each of your employers will give you a W2, which shows your income for the year. For freelance income, you’ll receive a 1099.

If you have investments, you’ll need records of that income. You’ll also need to gather your mortgage interest statements if you have a mortgage.

People who have moved in the past year may need to submit a change of address form. If you’ve gotten married in the past year or changed your name for other reasons, you should submit a name change form. And, if your overall household income has changed because of your marriage, you might want to submit a form confirming that.

If you have a lot of different sources of income, doing your own taxes can get confusing. In that case, you might want to get professional advice to prevent problems.

Fill Out The Forms

Once you have the paperwork you need, you’ll have to fill out your tax forms. When you’re filling them out, make sure that you claim any tax credits and deductibles that you’re eligible for.

The main form you’ll need to fill out to file your federal tax return is the 1040 form. On this form, you’ll list your address, any dependents you have and their information, your filing status, and your date of birth. You may also have to fill out a Schedule 1, Schedule 2, or Schedule 3 form depending on your taxes.

Your filing status depends on your marital status. You’ll list yourself as either single, head of household, widowed with dependent children, married but filing tax forms separately, or married and filing a joint tax return.

When you submit your taxes, you’ll have to choose between a standard deduction or itemized deductions. In most cases, you’ll benefit more from the standard deduction.

Submit Your Taxes

Once you have all your forms filled out correctly, it’s time to submit them. Your federal and state taxes will go to different places, ensuring that they each get to the right place. You can file your taxes online or mail them to the relevant department.

How To Do Your Own Taxes: Get Started

Now that you know how to do your own taxes, it’s time to sit down and start them. There’s no time to waste!

Do you need more financial advice? Some of the other posts on this website might be helpful for you.