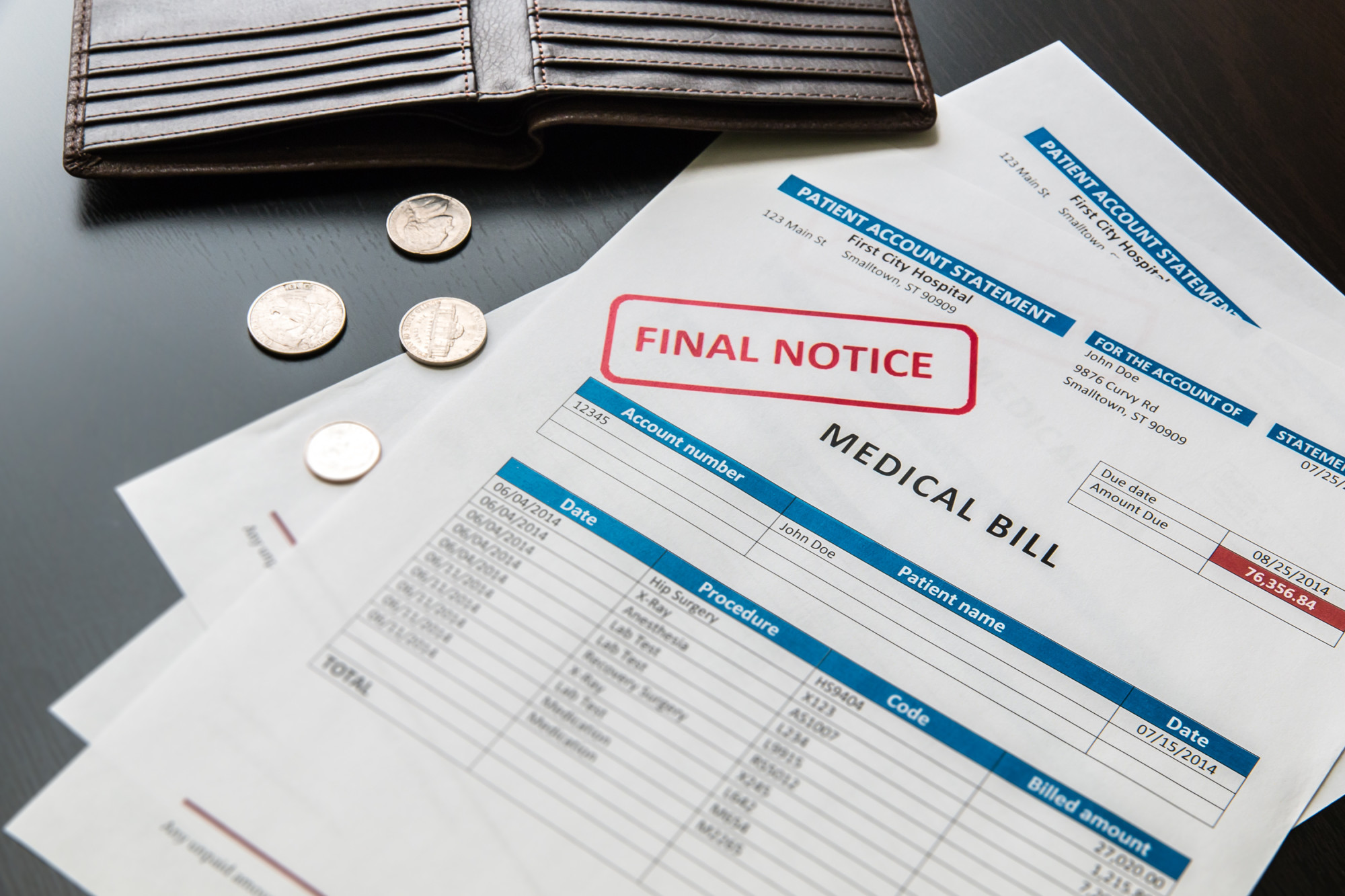

One in four Americans struggles to pay their medical debt, some even skipping necessary medical care because of the cost. The rising cost of healthcare in the United States is a major concern for many Americans, with medical bills often being one of the largest expenses individuals and families face. Even those with insurance may struggle to pay their hospital bill, as deductibles, copays, and other out-of-pocket costs continue to rise.

This can lead to financial hardship and even bankruptcy for some. If you’re unable to pay a hospital bill, it’s important to know that you’re not alone and that there are steps you can take to address the issue.

In this listicle, we’ll discuss five things you can do if you are unable to pay a medical bill. Read on to learn more.

1. Negotiate With the Hospital

Don’t be afraid to negotiate with the hospital. Many hospitals are willing to work with patients to set up a payment plan or reduce the amount owed on a hospital bill. Be honest about your financial situation and ask if any discounts or programs are available to help you.

2. Apply for Financial Assistance

Hospitals are required by law to provide financial assistance to low-income patients. You can apply for this assistance by filling out a financial assistance application, often found on the hospital’s website or obtained through their billing department.

3. Check for Billing Errors

A medical bill error is more common than you might think. Review your hospital bill carefully and make sure you’re not being charged for services you didn’t receive or that were incorrectly billed to your insurance. If you find an error, contact the hospital’s billing department to have it corrected.

4. Seek Help From a Patient Advocate

Patient advocates are professionals who can help you navigate the healthcare system, including hospital bills. They can help you understand your options and negotiate with the hospital on your behalf. Many hospitals have patient advocate programs, or you can hire a private advocate.

5. Consider Bankruptcy

While it should be a last resort, filing for bankruptcy can discharge medical debt and provide relief from debt collectors. Talk to a bankruptcy attorney to see if this is a viable option for you. You could even check out some loans for healthcare.

There Are Things You Can Do About Your Hospital Bill

If you’re struggling to pay a hospital bill, don’t panic. There are several options available to you, including negotiating with the hospital, applying for financial assistance, checking for billing errors, seeking help from a patient advocate, and considering bankruptcy.

Remember that ignoring your hospital bill will not make it go away, and it’s important to take action as soon as possible to avoid further financial consequences. By exploring your options and taking steps to address your medical debt, you can alleviate the burden and regain control of your financial well-being.

For more listicles like this check out our blog.