Spotloan is a popular short-term loan provider that offers installment loans, typically to those with less-than-perfect credit. As a tribal lender, Spotloan operates under tribal law, which allows it to offer flexible loan options that other traditional lenders may not provide. These types of loans, known as tribal loans like Spotloan, are often sought out by borrowers looking for quick access to cash without the stringent credit checks required by traditional financial institutions. However, several other lenders offer similar services, giving you more options to explore.

It’s important to note that these companies like Spotloan will often have higher interest rates, even higher than credit card rates. However, since they are made to be paid off quickly, you should be able to avoid overpaying on interest. Just make sure you can repay it without paying any penalties.

We’ve sourced the internet for the top online loans for short term lending. Below, you will find the best options that we believe are better alternatives. With lower interest rates, higher acceptance rates and easier procedures, you will have the money that you need now in no time!

Loans Similar to Spotloan

Overview of Spotloan

Spotloan provides installment loans with flexible repayment options, typically geared toward people with poor credit or those who need quick access to cash. Unlike payday loans, Spotloan’s installment loans allow borrowers to repay their loan in multiple installments over time, rather than a single lump sum. Spotloan is a tribal lender, meaning it operates under tribal law, offering flexibility that other lenders may not provide.

Key Features of Spotloan:

- Installment Loans: Borrowers can repay loans in fixed, manageable installments.

- No Prepayment Penalty: Borrowers can pay off the loan early without facing extra fees.

- Flexible Eligibility: Loans are available to those with less-than-perfect credit.

- Quick Approval: Fast approval process and access to funds.

While Spotloan is a convenient option for many, several Spotloan alternatives offer competitive features and flexible lending options.

Loans Similar to Spotloan

1. MaxLend

Official Site

MaxLend is a tribal lender that offers short-term installment loans, providing quick access to cash for individuals with less-than-perfect credit. As a tribal lender, MaxLend operates under tribal law, offering flexible loan terms and repayment options. Unlike traditional payday loans, MaxLend’s installment loans allow borrowers to repay over time in manageable payments, and they do not require a traditional credit check, making it accessible to those with poor or no credit. Funds are typically available by the next business day, making MaxLend a convenient choice for emergency financial needs.

Key Features:

- Installment Loans: Borrowers can repay the loan over multiple payments.

- No Credit Check: Offers loans like Spotloan with no credit check, making it accessible to those with poor credit.

- Fast Funding: Funds are typically available by the next business day.

Minimum Requirements:

- Must be at least 18 years old.

- Must have a regular source of income.

- Must have an active checking account.

2. SuperMoney

Official Site

SuperMoney is a financial comparison platform that helps users find and compare various financial products, including loans, credit cards, insurance, and investment services. It provides an easy-to-use interface where users can explore options from multiple lenders, allowing them to make informed decisions based on features like interest rates, loan terms, and fees. SuperMoney is known for its transparent approach, offering detailed reviews and ratings to help users choose the best financial solution for their needs.

Key Features:

- Loan Comparison Tool: Compare offers from multiple lenders in one place.

- No Credit Impact: Prequalification won’t affect your credit score.

- Multiple Loan Types: Personal loans, auto loans, student loans, and more.

Minimum Requirements:

- Varies by lender, but typically includes being at least 18 years old and having a regular source of income.

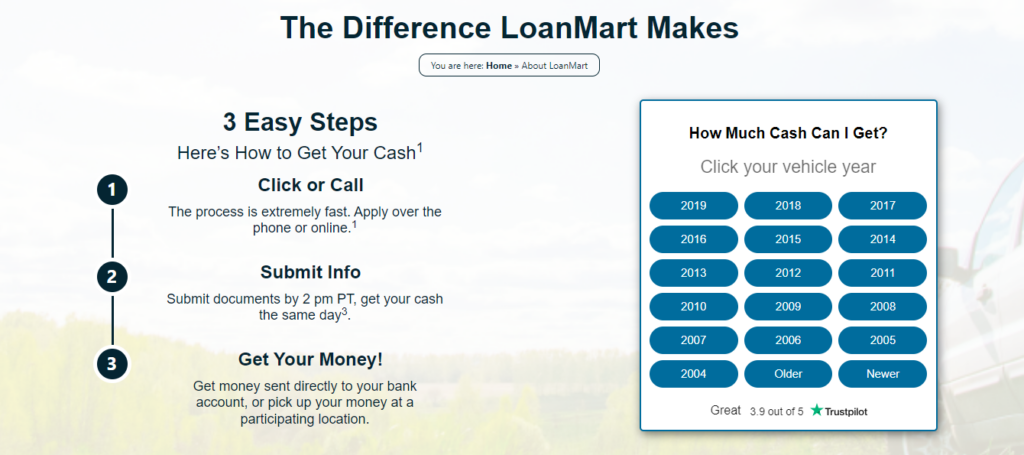

3. LoanMart

Official Site

LoanMart offers auto title loans, allowing borrowers to use their vehicle’s title as collateral. It is a good Spotloan alternative for those looking to leverage their assets for quick cash.

Key Features:

- Auto Title Loans: Borrow against your vehicle’s value.

- No Credit Checks: Loans like Spotloan with no credit check for borrowers with poor credit.

- Fast Approval: Approval within minutes and same-day funding in some cases.

Minimum Requirements:

- Must have a vehicle with a clear or nearly clear title.

- Must have proof of income.

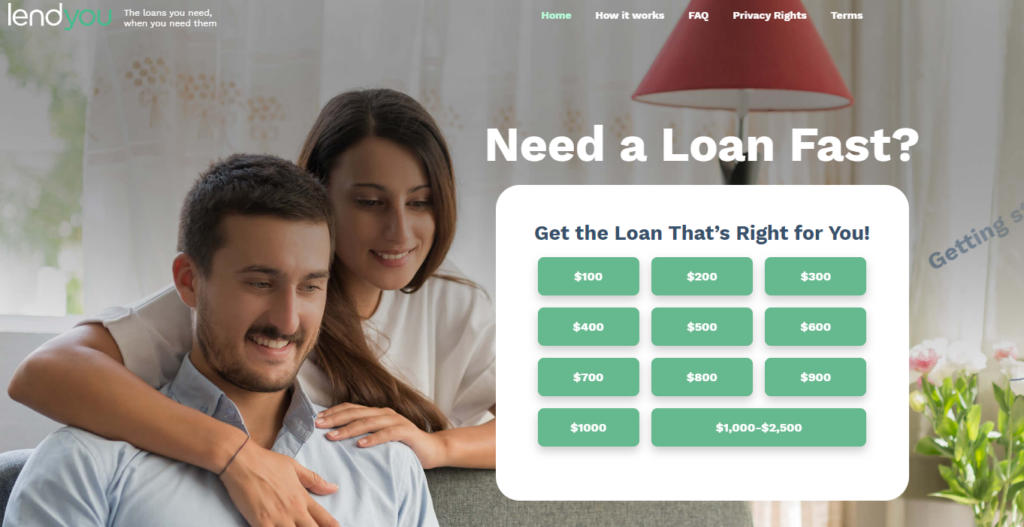

4. LendYou

Official Site

LendYou connects borrowers with lenders who offer short-term personal loans and payday loans. This platform is ideal for borrowers searching for payday loans similar to Spotloan.

Key Features:

- Loan Network: Connects you with multiple lenders for personal and payday loans.

- Quick Access to Funds: Get funds as soon as the next business day.

- Flexible Loan Terms: Terms vary based on the lender’s offers.

Minimum Requirements:

- Must be 18 years old and a U.S. citizen.

- Must have a regular source of income.

5. USANewLoan

Official Site

USANewLoan offers short-term personal and payday loans, making it a good Spotloan alternative for borrowers who need quick access to cash. It specializes in fast approval and short-term lending solutions.

Key Features:

- Fast Approval: Same-day approval and funding in most cases.

- Payday Loans: Short-term loans with flexible repayment options.

- No Credit Check: Loans like Spotloan with no credit check available for those with poor credit.

Minimum Requirements:

- Must be at least 18 years old.

- Must have a regular source of income.

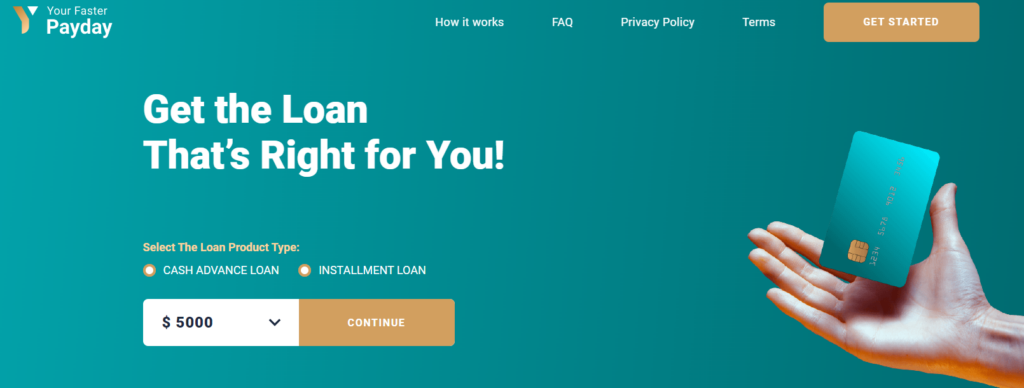

6. YourFasterPayday

Official Site

YourFasterPayday offers payday loans and installment loans, giving borrowers flexible repayment options. It’s ideal for those looking for payday loans similar to Spotloan with fast approval times.

Key Features:

- Quick Loan Approvals: Fast access to cash for emergencies.

- Payday Loans: Short-term payday loan options for small amounts.

- No Credit Checks: Loans are available regardless of credit history.

Minimum Requirements:

- Must be 18 years old with an active checking account.

- Must have a regular income.

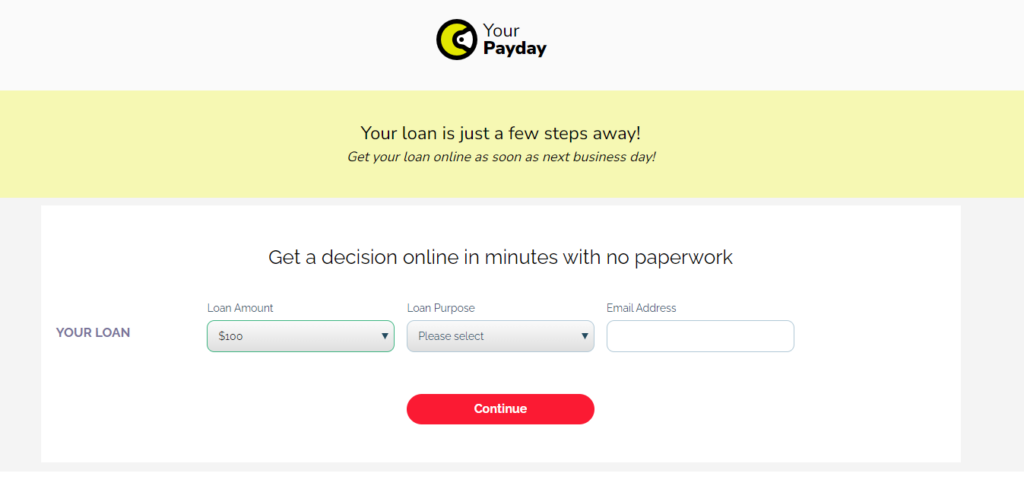

7. YourPayDay

Official Site

YourPayDay is another payday loan provider that offers short-term financial solutions for borrowers who need immediate cash. It’s a good choice for those looking for loans similar to Spotloan with flexible repayment options.

Key Features:

- Payday Loans: Short-term payday loans with fast approval.

- Flexible Repayment: Manageable repayment options with no penalties for early repayment.

- No Credit Check: Available to borrowers with poor or no credit.

Minimum Requirements:

- Must be at least 18 years old.

- Must have an active checking account and proof of income.

Does SpotLoan Work With Chime?

Chime is one of the most innovative banking services available in the United States. They rethink the way people bank online by removing some of the stigmas that make traditional banking off-putting.

With Chime, you don’t have to worry about overdraft fees – they simply don’t have any. Other benefits include not having monthly service fees and not needing to keep a minimum balance in your bank account.

Many people ask if Spotloan works with Chime – yes they do. Chime is a bank account just like any other, so as long as you can receive deposits and money transfers, they will easily be able to send you the funds directly to your Chime account. This also applies for all of the other lenders in our list above. The loan amount you are approved for will be directly deposited into your Chime account within 1 to 2 business days for most lenders.

Does SpotLoan Report to Credit Bureaus?

Spotloan does not report to the major credit bureaus, which include Equifax, TransUnion and Experian.

Why is this important to know? There are a few reasons why this is an important thing to know about. Firstly, if your lender reports to credit bureaus, then your credit score would quickly be affected if you miss any payments. This means if you miss a payment, it could lower your credit score and have a huge impact on being able to borrow more money in the future.

On the other hand, it also means that your good payments aren’t noted. This isn’t ideal, because if you’re working towards rebuilding your credit score and want to take out a small loan to bring your score up, this lender won’t do much good. Fortunately, the other loans like Spotloan mentioned above do report to credit bureaus in most cases, so have a look – making good payments will help drive up your score.

Do You Need Good Credit to Get a Loan?

Not necessarily! Even if you have a poor credit score, you can still get a loan today. Some of the lenders in our list above rely on different factors rather than just looking at your credit history. For instance, LendYou, our number one pick, looks at your monthly income. If you earn a minimum of $1,000 per month in income and can prove it, you could get approved for one of their short-term personal loans.

While having good credit is very important and is something you should constantly be working towards improving, it’s not necessary if you just need fast cash loans. Current salary as well as a few other factors can help you get the funding you need from a financial institution that is legitimate and trustworthy.

Spotloan Customer Service

- Email: help@spotloan.com

- Phone: (888) 681-6811

- Operating Hours: Monday – Friday 7 a.m. – 8 p.m. CT and Saturday 9 a.m. – 6 p.m. CT